34+ 15 and 30 year mortgage calculator

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. The influence of behavioral biases on aggregate outcomes like prices and allocations depends in part on self-selection.

Fha Mortgage Calculator With Monthly Payment Fha Mortgage Mortgage Loan Calculator Mortgage Amortization Calculator

Getting ready to buy a home.

. Scotiabank Mortgage Calculator Mortgage details. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. We document that.

While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. But borrowers can also take 10-year 20-year and 25-year terms. Depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original.

30 Year Mortgage Calculator Investment Property. Rental price 70 per night. Based on the FRED graph the 30-year fixed mortgage started with an average rate of 815 percent in January 2020.

30 and 15 Year Fixed Rates. Whether rational people opt more strongly into aggregate interactions than biased individuals. Your annual return was 9600 12000 2400.

GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path. They are also available in adjustable-rate. The amount going toward the principal in each payment varies throughout the term of the mortgage.

A reverse mortgage is a mortgage loan. Todays Mortgage Rates Mortgage Calculator. Whether you own a home already or are house-hunting homeowners insurance is a big part of your budget.

The surprise mortgage rate drop-off In 2018 many economists predicted that 2019 mortgage rates. Compared to a 30-year fixed mortgage 15-year fixed rate rates are. But some of 2012 was higher and the entire year averaged out at 365 for a 30-year mortgage.

In the year of sale you must report as wages the difference between the option price 20 and the value at the time the option. But it wasnt all bad news Marketwatch - Thu 934 AM. Todays mortgage rates in Texas are 5948 for a 30-year fixed 5104 for a 15-year fixed and 5153 for a 5-year adjustable-rate mortgage ARM.

Todays average fixed rate for a 15-year mortgage is 523 compared to the average of 519 a week earlier. Or 200 per month. In the UK and US 25 to 30 years is the usual maximum term although shorter periods such as 15-year mortgage loans are common.

Conventional loans are commonly offered in 15 and 30-year fixed rate loans. If a person. Loan term eg 15 years 30 years Loan description eg fixed rate 31 ARM payment-option ARM interest-only ARM Basic Figures for Comparison.

30 Year Mortgage Calculator Investment Property Calculator Home Improvement Loan Calculator. Its interest rate stays locked for the entire term resulting in predictable monthly principal and interest payments. Rates on a 15-year mortgage tend to be slightly less than a 30-year mortgage.

Fixed-rate mortgage interest rate and annual percentage rate APR For graduated-payment or stepped-rate mortgages use the ARM columns. By default 250000 30-yr fixed-rate loans are displayed in the table below. People typically move homes or refinance about every 5 to 7 years.

Lock-in Redmonds Low 30-Year Mortgage Rates Today. To calculate the propertys ROI. A Wonderful Opportunity To Own A Beautiful 3 Year Old Home In Norwood.

Our Canadian Mortgage Calculator allows you to calculate your monthly mortgage payments and cash needed for the purchase of real estate using current lender rates. This Bright And Spacious Home Is Located In A Quiet Family Friendly Subdivision. If you qualify for the 15-year rule your elective deferrals under this limit can be as high as 22500 for 2021.

A number of factors affect the cost of home insurance including the location of your home age claim history dwelling coverage limit and. A year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. Well find you.

Expenses including the water bill property taxes and insurance totaled 2400 for the year. This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate. And 14 months after that you sold your stock for 30 a share.

Loan term eg 15 years 30 years Loan description eg fixed rate 31 ARM payment-option ARM interest-only ARM Basic Figures for Comparison. Fixed-rate mortgage interest rate and annual percentage rate APR For graduated-payment or stepped-rate mortgages use the ARM columns. There are no more than two 30-day late mortgage or installment payments in the previous 24 months and there is no major derogatory credit on revolving accounts in the last 12 months.

How much money could you save. Stock Market News - Financial News - MarketWatch. 30 through 3408 35 through 3909.

If you can afford it consider taking a 15-year mortgage over a 30-year term. Mortgage payments which are typically made monthly contain a repayment of the principal and an interest element. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today.

Filters enable you to change the loan amount duration or loan type. The average rate for 2021 was 296 the. We conduct a series of betting market auction and committee experiments using 15 classic cognitive bias tasks.

Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. 15-year fixed mortgages also come with lower rates than longer payment durations. Build home equity much faster.

In 2000 the Census Bureau estimated that 34 million of the countrys 270 million residents were sixty-five years. Over the next couple of years between 2001 to 2008 it fluctuates between 707 percent and 585 percent. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate.

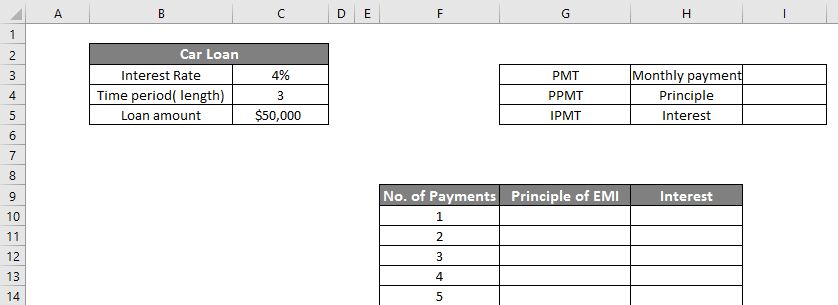

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

15 Mortgage Loan Calculators For Wordpress Wp Solver Mortgage Loan Calculator Mortgage Loans Mortgage Calculator

Pros And Cons Of Adjustable Rate Mortgages Adjustable Rate Mortgage First Time Home Buyers First Home Buyer

Amortization Schedule Amortization Schedule Car Loan Calculator Mortgage Amortization Calculator

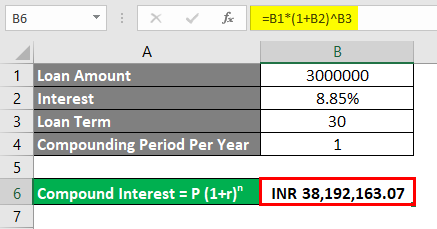

Calculate Compound Interest In Excel How To Calculate

15 Year Vs 30 Year Mortgage 30 Year Mortgage Mortgage Payment Budgeting

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Pros And Cons Of 15 Year Mortgages Buying First Home First Home Buyer Home Buying Tips

Mortgages 101 An Introduction To Interest Rates Infographic Mortgage Tips Home Mortgage Buying First Home

Calculate Compound Interest In Excel How To Calculate

Mortgage Calculation With A Mortgage Comparison Calculator Mls Mortgage Mortgage Loan Calculator Mortgage Comparison Mortgage Estimator

Mortgage Calculator By Digital Designer Calculator Design Mortgage Calculator Mortgage

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Fixed Vs Arm Mortgage Calculator Mls Mortgage Arm Mortgage Amortization Schedule Mortgage Amortization Calculator